Depreciation equation calculator

For example the first-year. Straight Line Depreciation - Formula Guide to Calculate.

How To Calculate Depreciation

Calculate the depreciation to be charged each year using the Straight Line Method.

. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash. This is the cost of the fixed asset. Accumulated Depreciation is calculated using the formula given below Accumulated Depreciation Cost of Asset Salvage Value Life of the Asset Noof years For 2nd Year Accumulated.

Depreciation Amount Asset Value x Annual Percentage. Calculate the revised depreciation. Depletion Method This method is usually used in case of the wasting.

Depreciation formula The Car Depreciation Calculator. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. Calculate the revised depreciation and make the journal entry for revised depreciation in year 3 and year 4. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

It provides a couple different methods of depreciation. Straight line depreciation is the most commonly used and. Depreciation Cost of asset Residual Value x Present value of 1 at sinking fund tables for the given rate of interest.

Depreciation Per Year Cost. The formula for calculating. The formula for calculating appreciation is as.

Our car depreciation calculator uses the following values source. Depreciation Per Year is calculated using the below formula. Here is the step by step approach for calculating Depreciation expense in the first method.

MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. As the truck has been used and. The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation.

After two years your cars value. There are three methods to calculate depreciation - the straight line depreciation the declining balance depreciation and the sum of years digits depreciation. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Also known as a Percentage Depreciation Calculator the. After a year your cars value decreases to 81 of the initial value.

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Accumulated Depreciation Definition Formula Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

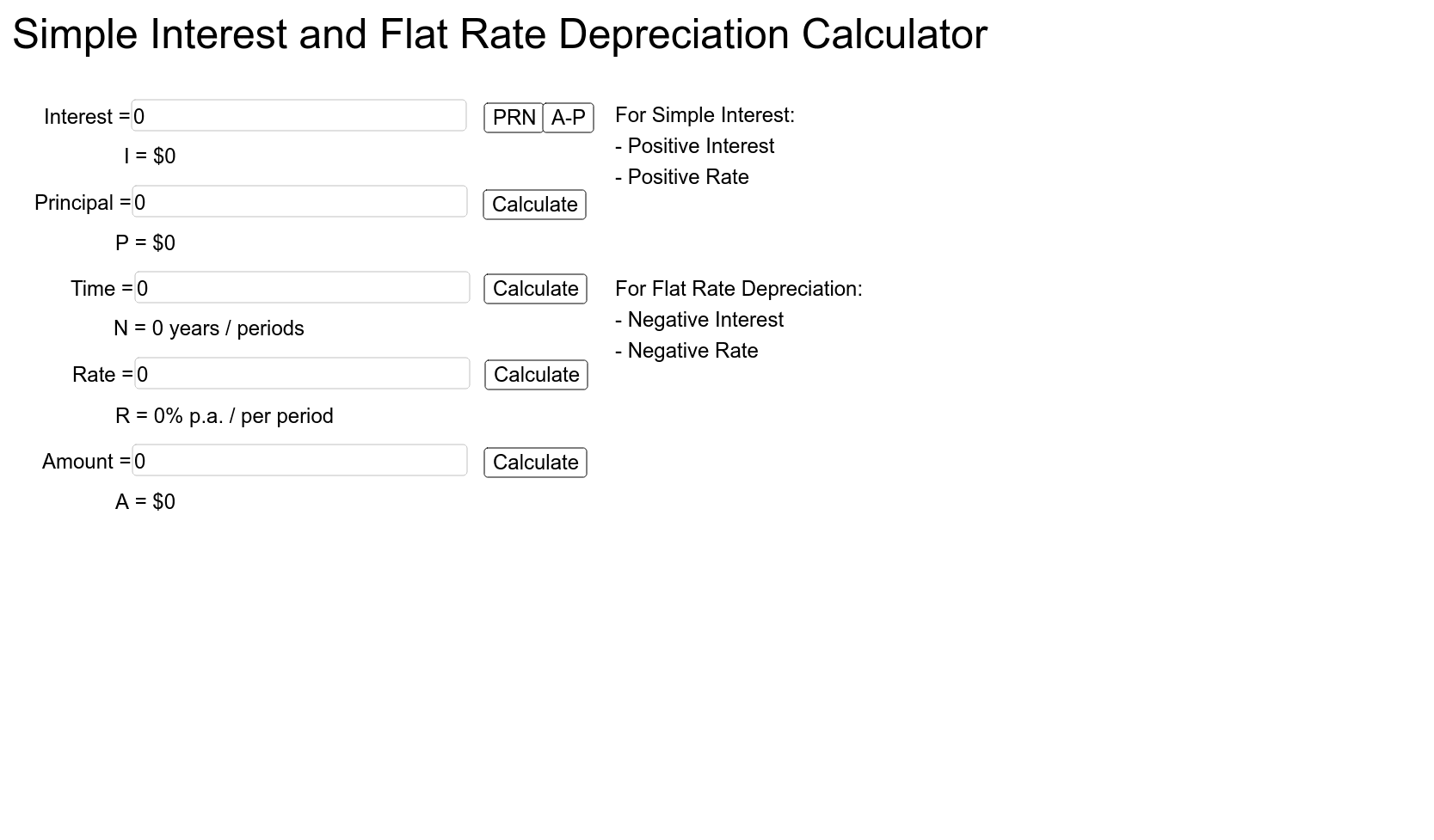

Simple Interest And Flat Rate Depreciation Calculator Geogebra

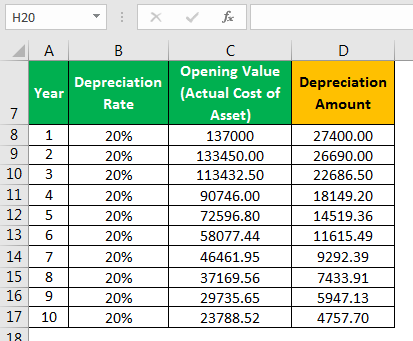

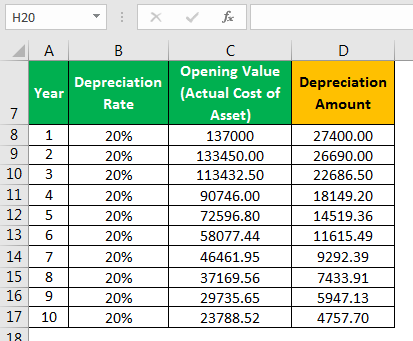

Depreciation Formula Examples With Excel Template

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Calculation

How To Calculate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Car Depreciation Calculator

Straight Line Depreciation Formula And Excel Calculator