How much can i borrow against my salary

You can get up to 3475. The lender will write down a 13000 debt against you.

This Is How Borrowing Things From Our Neighbors Strengthens Society Sharing Economy The Borrowers Social Fabric

Find out what you can borrow.

. I cant get that story outta my mind. Get in-depth analysis on current news happenings and headlines. How much you can get depends on your household income.

One slight slip such as a 2000 salary rather than a 20000 one can kibosh any application. Simply put our mortgage calculator takes into consideration how much you earn and whether youre buying on your own or with someone else. However youll need to be able to qualify for the mortgage on your own.

Thailands most updated English news website thai news thailand news Bangkok thailand aecnewspaper english breaking news. Once thats done you need to scan through to see what the major categories are. You can increase your home loan to pay out a divorce settlement.

Wage and salary earnings in covered employment up to an amount specifically determined by law see tax rate table below are subject to the Social Security payroll tax. Your postcode salary family size reason for the loan and whether youre a home owner. I dont know why.

Think carefully before securing other debts against your home. The government can find some charge to bring against any concern it chooses to prosecute. A young man 21 years of age working at an average salary - his Social Security contribution would in the open market buy him an insurance policy that would guarantee 220 dollars a month at age 65.

If you do not repay the loan the Cash app will charge a late payment fee of 5 of the outstanding balance. Can I remove my partner. Amount you can borrow.

Add this amount to your deposit and youll find the budget for your new home. Credit line up to Rs125 lakhs. This assumes that you dont have any existing debts and a clear credit rating.

How Often Can You Borrow Money from the Cash App. Anyone can read what you share. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Here lenders obtain the key details. The cash app allows you to borrow money up to 250 at a time. The most you could borrow in that scenario would be 50000.

In many ways this is the most important part. If you qualify then. Yes you can remove your partner from your home loan.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. Its a new era for Quarterback Tiers as 50 NFL coaches and executives have shaken up the elite ranks for 2022 the ninth incarnation of my annual survey. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your.

On the other hand if 50 of your vested account balance amounts to less than 10000 your plan may include an exception and allow you borrow up to 10000. Your home may. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

You can borrow money as often as you like but you must repay the loan plus interest within 30 days. Wage and salary earnings above this amount are not taxed. Before you can apply your employer needs to be signed up with a salary advance company so check with your manager or HR to see if they are.

You can refinance and extend your mortgage to 95 of the property value. In 2022 the maximum amount of taxable earnings is 147000. Your salary by 4.

You can use the Part C Monthly desired spend column of the Budget Planner to do this. As Martin says there are clear dangers to using this kind of service but in certain circumstances it can be a useful cheap way to borrow to cover one-off costs in a pinch. Youre not eligible for a grant.

Make sure you fill in the forms carefully. How to Calculate a Down Payment Amount. As a subscriber you have 10 gift articles to give each month.

Both grants offer the same amounts. You can use the above calculator to estimate how much you can borrow based on your salary. As you can see even as little as 05 difference in the income multiple can make a staggering difference in the size of the loan you can borrow and more importantly the type of property that you can afford.

You may be able to take more than one loan from your 401k but the total amount of your loan balance cant exceed these. One of the unique features of having a Salary Account with HDFC Bank is that you get the added benefit of Salary Plus a pre-approved credit line which can be activated instantly. You can usually borrow up to a combined loan-to-value ratio CLTV of 85 percent meaning the sum of your mortgage and your desired loan can make up no more than 85 percent of your homes value.

Unlike a residential mortgage where the amount you can borrow is based on your salary and your outgoings a Buy to Let mortgage is assessed on the rental income that the property is likely to generate. The aim is to have your books balancing so youre not spending more than you earn. A combined salary of 100000 could be eligible to borrow 400000.

To do that you need to work out how much you can spend on different areas of your life. Young guns Josh Allen Justin Herbert. Our mortgage calculator will give you an idea of how much you might be able to borrow.

This is the ratio between the amount youre borrowing against the value of the property. You may be eligible to a partial grant depending on household income. The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a.

Send any friend a story. Read unique story pieces columns written by editors and columnists at National Post. Lets presume you and your spouse have a combined total annual salary of 102200.

Watching Nica play with the nanny Tony nudges Carm to tell the story she heard about the unattended child nearly drowning in a pool with the adults all around - now brain dead. Do you have a partner. Or 4 times your joint income if youre applying for a mortgage.

Every businessman has his own tale of harassment. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. Lenders will typically need the rental income to be at least 125 of the monthly mortgage payments on an interest only basis or even up to.

Other Income 000. Interest paid only on amount used.

Personal Loan Should I Take One Personal Loans Finance Loans Loan

Business English Is An Important Field For Esl Learners Learning Business Vocabulary Can Help You To Improv Vocabulary Vocabulary Words Advertising Vocabulary

6 Tips For A Resume That Brings High Salaries The University Network Resume Post Grad Life College Motivation

Salary Finance Borrow Affordable Salary Deducted Loans

12 Questions To Ask Yourself Before Buying Something Buy Clothes Ways To Save Money Life On A Budget

Cleo Get Up To A 100 Spot

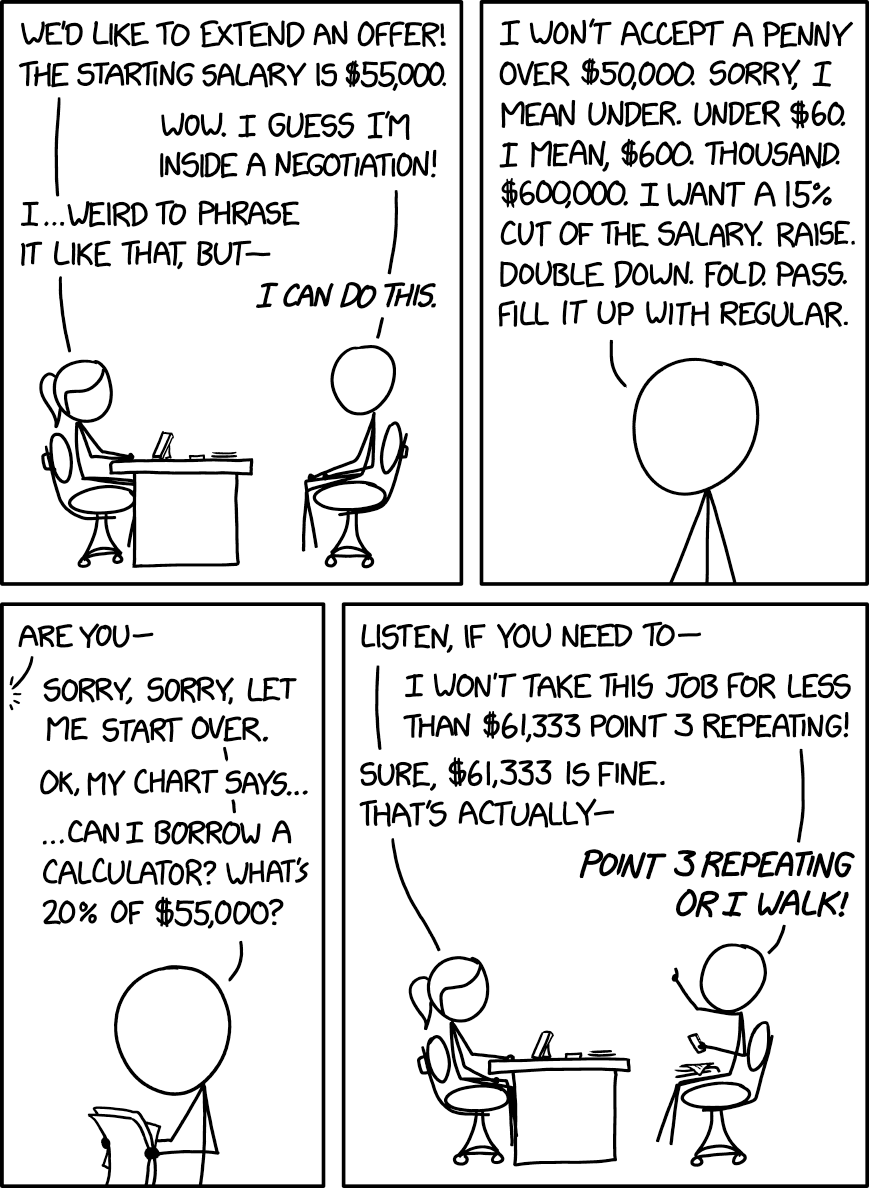

Xkcd Salary Negotiation

20 Financial Mistakes That 30 Year Olds Regret The Most Http Fitzvillafuerte Com 20 Financial Mistakes That Financial Mistakes Emergency Fund Money Matters

Business English Words Anglais English Parleranglais Coursanglais Englishlesson Esl Businessenglish English Vocabulary Vocabulary Words Learn English

Business English Top 100 Most Popular Words In Business English You Should Know Love Eng English Vocabulary Words Good Vocabulary Words Essay Writing Skills

Money Interactive And Downloadable Worksheet You Can Do The Exerc Reading Comprehension Strategies English As A Second Language Esl Comprehension Strategies

How Much Of Your Salary Should You Save Financial Goals Savings And Investment Salary

Payroll Deduction Loans A Helpful Guide Stately Credit

Need To Borrow A Lot Of Money Get A 100 000 Personal Loan Forbes Advisor

All The Ins Outs And How To S Of Life Insurance Simplified And Explained For You Life Insurance Insurance Marketing Insurance

Salary Finance Borrow Affordable Salary Deducted Loans

12 Questions To Ask Yourself Before Buying Something Buy Clothes Ways To Save Money Life On A Budget